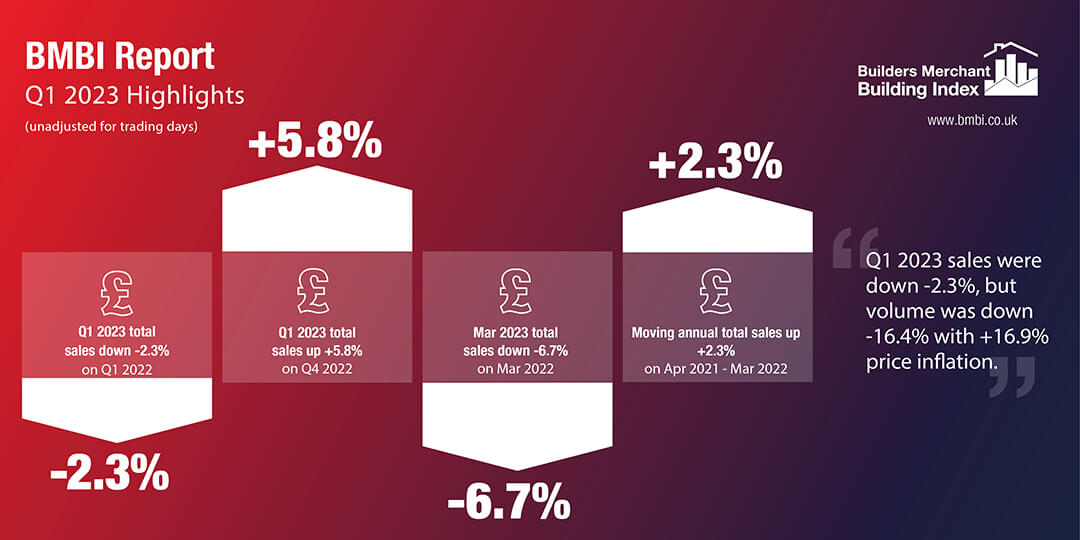

Q1 2023 sales drop -2.3% as volumes tumble -16.4%

Total value sales data from Britain’s Builders’ Merchants shows Q1 2023 recorded a -2.3% drop in year-on-year growth, with volume sales falling -16.4% countered by +16.9% price inflation. With one more trading day this year, like-for-like value sales were -3.8% lower.

Nine of the 12 categories sold more in Q1 2023 compared to the previous year with Renewables & Water Saving starting the year in pole position (+42.3%). Workwear & Safetywear (+14.9%), Decorating (+13.9%) and Plumbing, Heating & Electrical (+12.8%) also performed well. Services (-4.5%), Timber & Joinery Products (-15.3%) and Landscaping (-18.3%) all sold less.

Quarter-on-quarter, total value sales were up +5.8% in Q1 2023 compared to Q4 2022. Volume sales edged up +0.6% and prices climbed +5.2%. With five more trading days in the most recent period, overall like-for-like sales were -2.5% lower than October to December 2022. Renewables & Water Saving (+22.3%) was the strongest category, followed by Tools (+11.8%), Ironmongery (+11.1%) and Heavy Building Materials (+6.4%). Services (-2.4%) was the weakest category.

March sales contributed to the fall in Q1 sales, as total value sales for the month dropped -6.7% compared to March 2022. Volume sales in March 2023 fell -19.7% year-on-year and prices rose +16.2%. There was no difference in trading days. Seven of the 12 categories sold more with Renewables & Water Saving (+26.6%) again in the lead. Workwear & Safetywear (+19.7%), Plumbing, Heating & Electrical (+8.4%), Decorating (+7.9%) and Kitchens & Bathrooms (+7.3%) also grew. Tools (-1.1%), Heavy Building Materials (-1.6%), Services (-9.6%), Timber & Joinery Products (-17.0%) and Landscaping (-25.6%) sold less.

Compared to the previous month, March 2023 total merchant sales were +14.8% up on February 2023. Volume sales were +13.2% higher and price inflation was up +1.4%. All categories sold more, with seasonal category Landscaping (+25.4%) increasing the most followed by Workwear & Safetywear (+19.3%). Renewables & Water Saving (+4.9%) grew the least.

Mike Rigby, CEO of MRA Research who produce this report, said: “Before the turn of the year, the industry was bracing itself for a tough 12 months and 2023 hasn’t failed to deliver. The latest BMBI figures show a drop in year-on-year value sales, with a steep decline in volumes offset by an equally sharp increase in prices.

“Wet and cold weather in Q1 was surely responsible for some of the drop in demand, particularly for heavy building materials. Housebuilding starts fell again at the turn of the year, as mortgage approvals hit a record low, further kicking the new build housing sector while it was down. But consumer confidence is steadily climbing (-30 in April’s GfK Consumer Confidence Index, up from -45 in January) and with a bit of positive movement in inflation and interest rates, we can look forward to better days ahead. The repair, maintain and improve (RMI) market is showing signs of buoyancy so perhaps there will be more to shout about in Q2.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

The Q1 2023 BMBI report is available to download at www.bmbi.co.uk.